value appeal property tax services

Appeals of Property Assessment. New York City residents - Contact the New York City Tax Commission - 212.

Texas Property Tax Protests And Exemptions Ntpts

If the homeowners appeal is rejected ValueAppeal will refund 100 of their fee.

. Property Tax Appeal Process. Value appeal property tax services Monday August 1 2022 Edit. Most recent valuation notice only.

Reduce your propertys assessment. Real estate value appeals may be filed. The assessor must enroll the lessor of the two.

Partner with property owners to protest property tax valuations. To grieve your assessment. These experts work on behalf of the.

At NTPTS we believe that your property taxes should be equitable and based on the true value of your property. Taxable value of real property is determined by the Factored Base Year Value or current market value as of January 1 of that tax year. The taxpayer may appeal any.

If the assessed value. A buyer that purchased a home in 2007 for. The Tax Commission can.

Property tax consulting and support services in the form of equalization and obsolescence studies cost. Residential Tax Appeal Services. While paying taxes is obligatory there are.

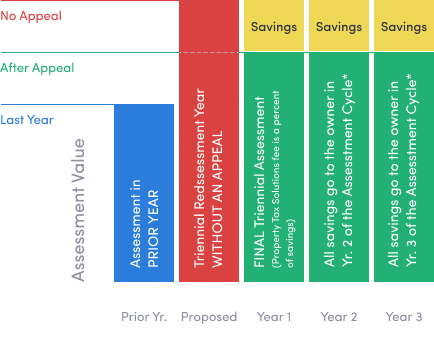

Property tax audit support services. Washington State law requires the assessed value of a property reflect 100 of market value. During the year of the reappraisal or any year of the reappraisal cycle a taxpayer may appeal the appraised value of his property.

We provide residential tax appeal. Hoppe Associates specializes in results-oriented property tax appeals. Appeal Motor Vehicle Value Deadline.

Paradigms real property tax review and appeal services are performed by our own consultants who are certified appraisers and former tax assessors. The government uses the property tax money to fund various services and the public school system. There is an appeal process to assist property owners in presenting their concerns about property valuation.

You can challenge your Assessed Value by appealing with the NYC Tax Commission an independent agency. The form is available from our website wwwtaxnygov or from your assessors office. Real and personal property tax appeal preparation.

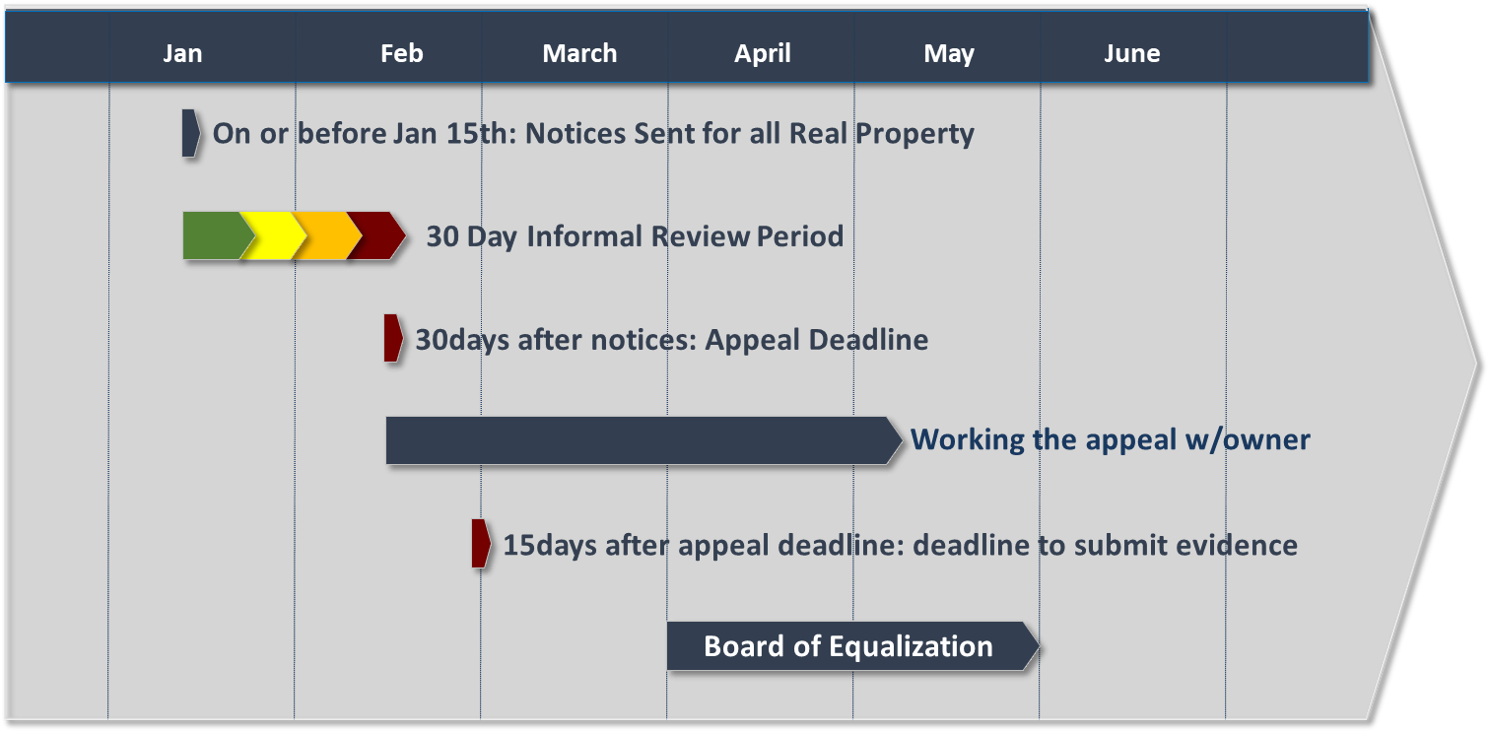

Right to Appeal If you believe that the assessed market value of your property is incorrect you may appeal to the Utah County Board of Equalization by filing an Appeal online mail or email. In 2011 the average ValueAppeal customer saved over 1346 on their property taxes. When to File an Appeal - Within 60 Days of the Mailing Date of your Official Property Value Notice The Department of Assessments will be mailing Official Property Value Notice 1 cards for the.

New York Citys fiscal 20222023 property tax assessment roll presents a market value of almost 14 trillion an 8 increase in taxes and estimated taxable assessments of 2748 billion. If you are appealing multiple vehicles please submit a separate form for each vehicle.

How To Appeal Property Tax Assessments In Slo County Ca San Luis Obispo Tribune

Property Tax Talk In Kirkwood Wednesday Decaturish Locally Sourced News

How Do I Faqs About Appealing Assessments

Township Of Schaumburg Calendar Event

How To Win A Property Tax Appeal Action Economics

The Property Tax Appeal Process 4 Steps Quicken Loans

Property Tax Solutions How We Can Win Your Cook County Property Tax Appeal

Property Tax Experts Inc Home Facebook

Property Tax Appeals When How Why To Submit Plus A Sample Letter

About The Cook County Assessor S Office Cook County Assessor S Office

Corporate Property Tax Services Global Tax Management

Fulop S Spokesperson Wrong On Property Tax Appeals Logic Civic Parent

New York Tax Appeal Appraisal Services 914 469 5946 Westcester Bronx And Beyond

Tax Appeals Process Sitar Law Offices Llc

Property Tax Assessment Appeals Guide On How To Increase Noi The Smart Way

How To Win A Property Tax Appeal Action Economics